What Is an Annuity?

An annuity is a financial product typically offered by insurance companies that’s designed to provide regular income—often during retirement. You can think of it as a way to turn your savings into a paycheck that lasts for a set period, or even the rest of your life.

The idea is simple: You pay money into the annuity, either as a lump sum or through a series of payments. Later, you receive a stream of income based on the amount you invested, the terms of the contract, and other factors like interest rates or market performance.

How Do Annuities Work?

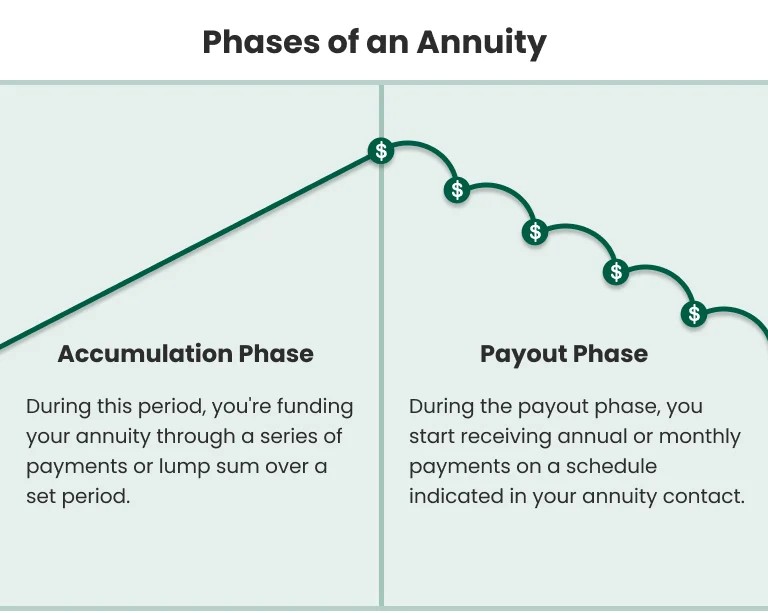

Annuities work in two main phases:

- Accumulation Phase: This is when you’re paying into the annuity. You can contribute all at once or over time, depending on the type you choose.

- Distribution Phase: This is when the annuity starts paying you. Payments can begin immediately or be deferred until a future date (such as retirement).

Types of Annuities

Not all annuities are the same. Here are the three most common types:

1. Fixed Annuities

These provide guaranteed payments and are often considered the safest option. You’ll know exactly how much you’re going to receive, which can help with budgeting and peace of mind.

2. Variable Annuities

These allow your money to be invested in various funds. Your payments will fluctuate based on the performance of those investments. They offer potential for higher returns, but come with more risk.

3. Indexed Annuities

These are tied to a stock market index (like the S&P 500), offering some growth potential with limited downside. They’re often seen as a middle ground between fixed and variable annuities.

Benefits of Annuities

Guaranteed Income: One of the biggest appeals is the ability to receive income for life, which helps guard against outliving your savings.

Tax-Deferred Growth: Your investment can grow without being taxed until you withdraw funds.

Customizable Options: You can add features, known as “riders,” to cover things like long-term care or leave a death benefit for heirs.

Potential Drawbacks

Fees: Some annuities, especially variable ones, come with high fees.

Complexity: Annuity contracts can be difficult to understand without guidance.

Limited Liquidity: Withdrawing money early often results in penalties.

Surrender Charges: These fees apply if you pull your money out too soon—typically within the first 5–10 years.

Who Might Consider an Annuity?

Annuities aren’t for everyone, but they can be a great option for:

- People Nearing or Entering Retirement: Individuals approaching or in retirement who want predictable, lifelong income streams to cover basic living expenses.

- Those Worried About Running Out of Money Later in Life: Annuities can provide lifetime payments, making them attractive to those concerned about longevity risk and running out of money later in life.

- Investors Looking for Predictable, Stable Income: People who prefer low-risk investments and value stability over high returns, especially those looking for protection against market volatility.

- High Earners Looking for Tax Deferral: Individuals in higher tax brackets who have maxed out their 401(k) and IRA contributions and want additional tax-deferred growth.

- Individuals Without a Pension: Those who do not have a traditional pension may use an annuity to create a personal pension-like income stream.

Questions to Ask Before Buying

Before purchasing an annuity, ask yourself (or your advisor):

- What kind of annuity is this?

- What are the total fees involved?

- How long is the surrender period?

- What income options are available?

- How will this fit into my overall retirement plan?

- What happens to the annuity if I pass away?

Final Thoughts

Annuities can be a powerful financial tool—but like any investment, they’re not one-size-fits-all. The key is understanding how they work and whether they align with your personal goals.

Working with a trusted financial advisor can help you determine if an annuity fits into your broader retirement strategy.

Let’s Talk About Your Retirement Plan

Curious whether an annuity makes sense for you? I’d be happy to walk you through your options and help you create a personalized retirement income plan.

👉 Call (404) 838-9374 to schedule your free consultation here.

📩 Or email me at Shumake_Andrew@nlgroupmail.com to get started.